All Categories

Featured

Table of Contents

That usually makes them an extra budget-friendly alternative forever insurance policy coverage. Some term plans may not keep the costs and death profit the very same with time. 20-year level term life insurance. You do not wish to erroneously believe you're buying degree term coverage and then have your fatality benefit modification in the future. Lots of people obtain life insurance policy protection to aid financially secure their enjoyed ones in instance of their unexpected fatality.

Or you might have the choice to convert your existing term coverage into a permanent plan that lasts the rest of your life. Numerous life insurance plans have possible advantages and downsides, so it's essential to understand each before you make a decision to purchase a policy.

As long as you pay the costs, your recipients will get the fatality benefit if you die while covered. That said, it is necessary to note that most plans are contestable for two years which suggests insurance coverage can be rescinded on death, should a misrepresentation be found in the application. Plans that are not contestable often have a rated fatality benefit.

What is Term Life Insurance With Accelerated Death Benefit and Why Is It Important?

Premiums are generally reduced than whole life policies. You're not locked right into an agreement for the rest of your life.

And you can't pay out your plan during its term, so you won't get any kind of economic gain from your previous coverage. Similar to other kinds of life insurance, the price of a level term policy depends upon your age, coverage needs, employment, way of life and wellness. Normally, you'll locate a lot more budget friendly coverage if you're younger, healthier and much less dangerous to insure.

Given that degree term costs remain the exact same for the duration of insurance coverage, you'll understand specifically how much you'll pay each time. Level term insurance coverage likewise has some versatility, permitting you to tailor your policy with extra features.

What Are the Terms in Term Life Insurance For Seniors?

You might have to meet specific problems and credentials for your insurance firm to establish this rider. On top of that, there may be a waiting period of up to six months prior to taking impact. There also could be an age or time limitation on the coverage. You can include a kid motorcyclist to your life insurance policy policy so it additionally covers your children.

The survivor benefit is commonly smaller, and coverage usually lasts up until your child transforms 18 or 25. This cyclist might be a more cost-efficient way to help guarantee your youngsters are covered as bikers can typically cover multiple dependents simultaneously. Once your child ages out of this insurance coverage, it may be feasible to transform the motorcyclist right into a brand-new policy.

When contrasting term versus long-term life insurance policy, it is necessary to bear in mind there are a couple of various types. The most usual kind of irreversible life insurance policy is entire life insurance policy, yet it has some key distinctions contrasted to level term coverage. Level term life insurance meaning. Below's a basic summary of what to think about when contrasting term vs.

Whole life insurance policy lasts for life, while term protection lasts for a details period. The premiums for term life insurance policy are commonly reduced than entire life coverage. With both, the costs stay the exact same for the period of the plan. Entire life insurance policy has a cash money value element, where a portion of the premium might expand tax-deferred for future needs.

One of the major features of degree term insurance coverage is that your costs and your fatality advantage don't transform. You might have protection that starts with a death advantage of $10,000, which could cover a home loan, and after that each year, the death advantage will reduce by a set quantity or portion.

Due to this, it's typically a much more cost effective kind of level term insurance coverage., but it may not be adequate life insurance policy for your requirements.

What is Term Life Insurance With Accelerated Death Benefit Coverage Like?

After deciding on a policy, complete the application. For the underwriting process, you may have to supply basic individual, health and wellness, lifestyle and work details. Your insurance firm will identify if you are insurable and the risk you may present to them, which is shown in your premium prices. If you're accepted, authorize the documents and pay your initial costs.

Ultimately, consider organizing time each year to assess your policy. You may intend to upgrade your beneficiary details if you have actually had any kind of significant life modifications, such as a marriage, birth or separation. Life insurance policy can often feel complicated. You do not have to go it alone. As you discover your choices, take into consideration reviewing your demands, wants and interests in a financial expert.

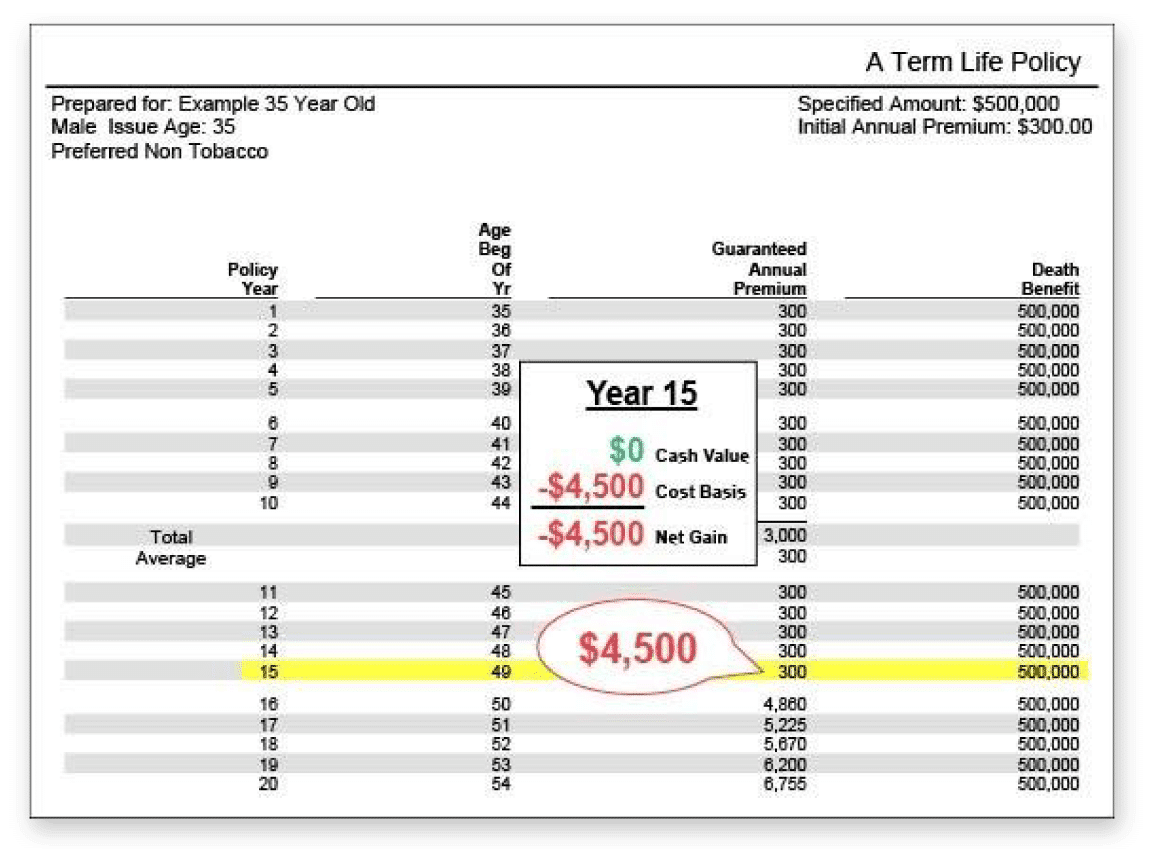

No, level term life insurance policy does not have cash worth. Some life insurance policy policies have a financial investment feature that permits you to develop cash value with time. A section of your costs payments is reserved and can earn passion over time, which expands tax-deferred during the life of your coverage.

You have some options if you still want some life insurance policy coverage. You can: If you're 65 and your insurance coverage has run out, for instance, you might want to purchase a new 10-year degree term life insurance coverage policy.

What is Level Term Life Insurance Policy? Pros and Cons

You might have the ability to transform your term protection into a whole life policy that will certainly last for the remainder of your life. Several kinds of degree term plans are exchangeable. That suggests, at the end of your protection, you can convert some or every one of your plan to entire life coverage.

A level premium term life insurance policy strategy allows you stick to your budget plan while you help protect your family. ___ Aon Insurance Coverage Providers is the brand name for the broker agent and program administration procedures of Fondness Insurance coverage Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Firm, Inc. (CA 0795465); in OK, AIS Fondness Insurance Coverage Services Inc.; in CA, Aon Fondness Insurance Services, Inc .

Latest Posts

Final Expense Insurance Policies

Burial Coverage

Securus Final Expense