All Categories

Featured

Table of Contents

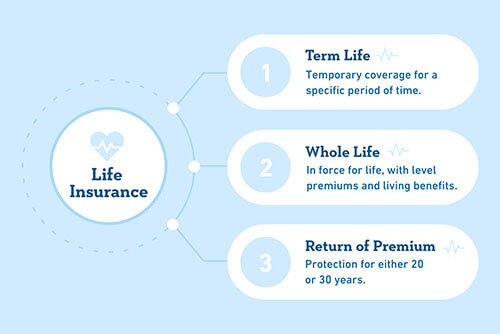

A level term life insurance policy can give you satisfaction that the individuals that depend on you will have a survivor benefit during the years that you are planning to support them. It's a means to aid deal with them in the future, today. A level term life insurance coverage (occasionally called degree premium term life insurance policy) plan offers coverage for an established variety of years (e.g., 10 or twenty years) while maintaining the costs payments the same throughout of the plan.

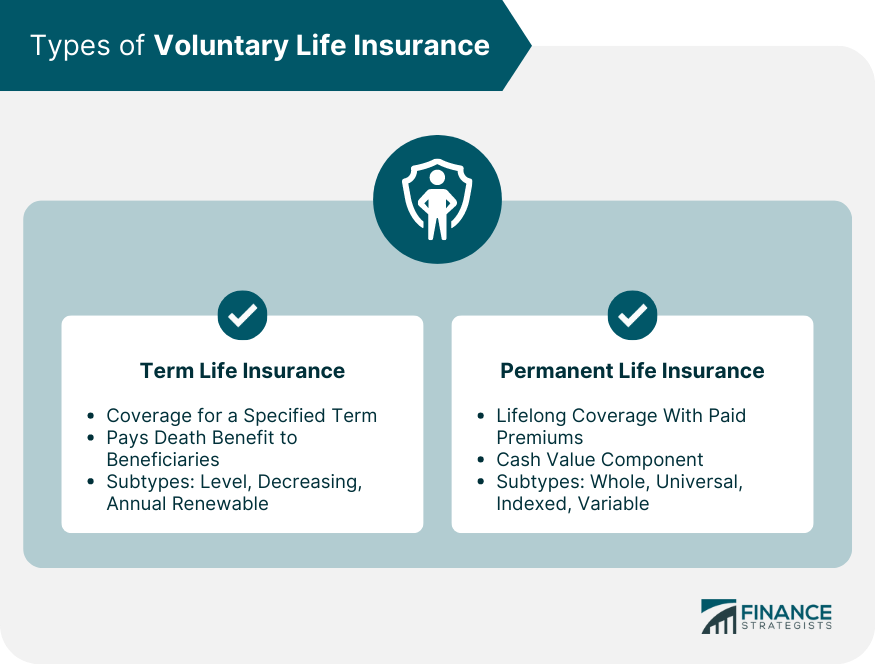

With level term insurance, the cost of the insurance policy will certainly remain the very same (or possibly decrease if rewards are paid) over the regard to your plan, normally 10 or 20 years. Unlike irreversible life insurance policy, which never runs out as long as you pay costs, a degree term life insurance plan will certainly finish eventually in the future, typically at the end of the duration of your level term.

What is Level Benefit Term Life Insurance Coverage?

Due to this, lots of people make use of permanent insurance policy as a steady economic planning device that can serve several demands. You may have the ability to transform some, or all, of your term insurance throughout a collection period, typically the first 10 years of your plan, without needing to re-qualify for coverage even if your wellness has changed.

As it does, you may desire to include to your insurance policy coverage in the future - Joint term life insurance. As this happens, you may want to ultimately minimize your death advantage or think about transforming your term insurance policy to a permanent policy.

As long as you pay your costs, you can rest simple understanding that your liked ones will certainly receive a survivor benefit if you die throughout the term. Lots of term plans permit you the ability to transform to long-term insurance coverage without having to take an additional wellness test. This can permit you to make the most of the fringe benefits of a permanent plan.

Level term life insurance policy is just one of the most convenient courses right into life insurance policy, we'll go over the advantages and disadvantages so that you can pick a strategy to fit your needs. Level term life insurance policy is the most typical and fundamental kind of term life. When you're trying to find temporary life insurance strategies, degree term life insurance policy is one route that you can go.

You'll fill up out an application that consists of basic personal info such as your name, age, and so on as well as a more comprehensive questionnaire concerning your clinical history.

The brief answer is no., for example, let you have the comfort of death advantages and can accrue cash money value over time, meaning you'll have more control over your advantages while you're active.

What is What Is Level Term Life Insurance? Pros, Cons, and Considerations?

Motorcyclists are optional arrangements included in your plan that can provide you extra advantages and defenses. Bikers are a wonderful way to include safeguards to your plan. Anything can take place throughout your life insurance policy term, and you intend to await anything. By paying just a little bit a lot more a month, cyclists can provide the support you require in instance of an emergency situation.

There are instances where these benefits are constructed right into your policy, yet they can additionally be available as a separate addition that needs added settlement.

Table of Contents

Latest Posts

Final Expense Insurance Policies

Burial Coverage

Securus Final Expense

More

Latest Posts

Final Expense Insurance Policies

Burial Coverage

Securus Final Expense